BY ALEX WEPRIN | HollywoodReporter.Com

Troy Warren for CNT #Entertainment #Business

The Wall Street logic with the studio buys is that the real estate will appreciate in value, while the non-stop demand in film and TV productions provide steady and stable cashflow.

Private equity is doubling down on Hollywood.

After dipping their toes in the water through the talent agencies (TPG owns a majority stake in CAA, while Silver Lake is the largest external shareholder in Endeavor), investment firms have been on a spending spree, snapping up stakes in production entities, or financing new vehicles like Kevin Mayer and Tom Staggs’ Candle Media to do the buying for them.

“You are looking at an enormous amount of capital in the hands of some very smart people, including my friend Kevin [Mayer],” Medialink founder Michael Kassan said during a panel at the CES show Jan. 6.

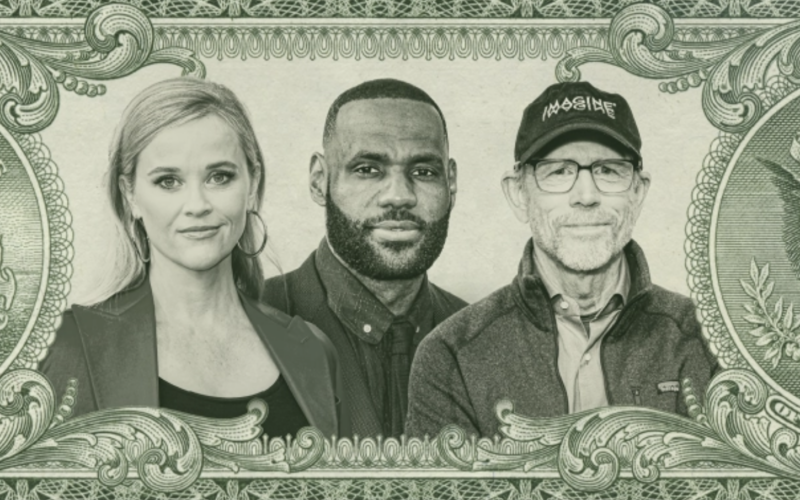

Candle, which is backed by billions of dollars from Blackstone, has already purchased stakes in Reese Witherspoon’s Hello Sunshine and Will and Jada Pinkett-Smith’s Westbrook Media; and has bought outright Cocomelon owner Moonbug and Fauda producer Faraway Road. Meanwhile, Imagine Entertainment is engaged in talks to sell a majority stake to the London-based firm Centricus, as reported by The Wall Street Journal. LeBron James’ SpringHill sold a stake to RedBird Capital, while Village Roadshow and Chernin Entertainment, sensing opportunity, have also begun to explore their options.

As for what’s causing the demand, look no further than the annual “Peak TV” data released by FX Networks Jan. 14. The data showed that in 2021 broadcast and cable channels, as well as streaming services, presented 559 English-language scripted series, a new record, and a 13 percent jump from pandemic-impacted 2020.

“There’s folks looking for a lot of supply,” a top agency source said. “Every streaming service needs unique high-quality content to drive new eyeballs and subs, and at the same time, a lot of these companies still need to program linear TV channels, so it is almost all additive.”

The bet is that original programming, especially programming from blue-chip talent or independent studios, will not abate anytime soon, and may continue to increase as streaming services seek to stand out. In other words, “Peak TV” hasn’t peaked yet. “The competition for content is at its highest level I’ve seen in 26 years,” Endeavor CEO Ari Emanuel remarked at the Code Conference on Sept. 28.

“We have a thesis, and that thesis is content, community, and commerce,” Mayer described of Candle Media’s ambitions at the CES show Jan. 6. “We feel that high-quality content with high-quality creators at the right brands create great connections in social media with large audiences.”

The thesis that demand for content will continue to surge has also led to investment firms buying up soundstages and physical studios. Hackman Capital alone has purchased Kaufman-Astoria Studios and Silvercup Studios in New York, as well as Los Angeles’ CBS Studio City lot, and has purchased or is developing studio space in Scotland and Toronto, among other locales. Meanwhile TPG purchased Studio Babelsberg in Germany, and Domain Capital Group developing a new studio in Georgia.

The logic with the studio buys is that the real estate will appreciate in value, while the non-stop demand in film and TV productions provide steady and stable cashflow.

Meanwhile, talent like Witherspoon, Smith and James are on board with the private equity cash as well, knowing that their financial backers have deep pockets, and are willing to sell to the channel or streaming service willing to cut the best deal. By contrast, every entertainment conglomerate is increasingly creating films and TV shows first and foremost for their owned services.

However, their desire to work with name-brand talent or producers remains, ensuring that firms like SpringHill and Hello Sunshine stay in demand.

“Nobody wants to be dictated to where and how and what they can create,” said one longtime studio executive, of the push by PE into star-backed studios. “This represents what may be a very important new paradigm for the future.”

Lesley Goldberg contributed reporting.