BY GEORG SZALAI | HollywoodReporter.Com

Troy Warren for CNT #Business

As AT&T plans to spin off WarnerMedia to then merge it with Discovery, it’s turning to a deal structure that’s been used just a handful of times in the media industry.

“Iconic brands and franchises,” “complementary assets,” “one of the largest global streaming players.” The buzzy phrases offered up to tout the megamerger of Discovery and AT&T’s WarnerMedia when the companies unveiled it on May 17 just rolled off the tongue.

The same can’t quite be said about the type of deal the partners agreed on to pull off the marriage: a so-called Reverse Morris Trust transaction. “It’s an extremely rare structure for media/communications/entertainment,” a representative of M&A and other capital markets data provider Dealogic explains to THR. The firm’s data going back to 1995 finds only eight sector deals on record that have used it. Among them are the 2017 takeover of CBS Radio by Entercom (now known as Audacy) and Walt Disney’s 2007 divestiture of ABC Radio to Citadel.

The fact that famously tax-averse media mogul John Malone, Discovery’s largest shareholder, has used the structure in the past is a tip-off to its key benefit, says Moody’s analyst Neil Begley. “It’s all about making it tax-free to the seller and shareholders,” he explains. “It’s as plain as that.”

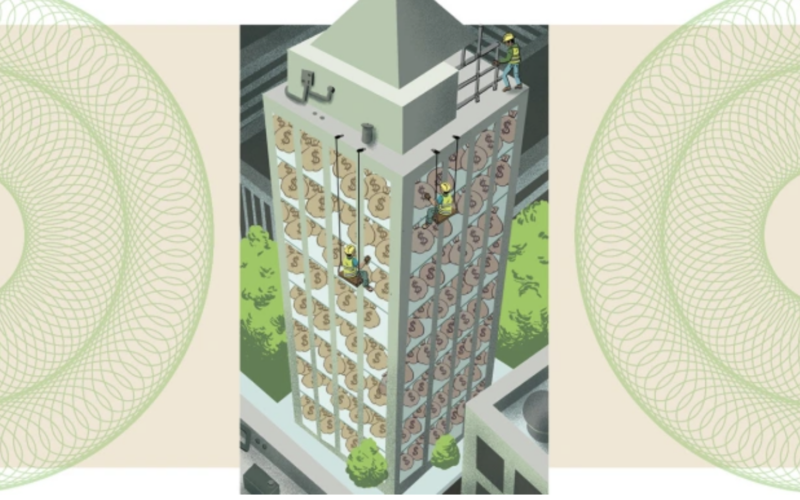

So how does a Reverse Morris Trust transaction work? A company, such as AT&T, separates via a spinoff or a split-off (more on that later) of an asset it wants to shed. Here, it’s WarnerMedia, which within the structure is referred to as the SpinCo. That’s immediately followed by a prearranged merger with another business, in this case: Discovery.

In most business combinations, a bigger company simply buys a smaller rival. But in the Reverse Morris Trust structure, the deal partner is smaller than the SpinCo and comfortable ceding majority control to shareholders of SpinCo.

To ensure that such a deal is tax-free, the shareholders of the divesting company (AT&T) need to retain a majority to be able to prove to the IRS that there technically was no sale with capital gains that could be taxed. For the chance to own part of the new sector giant known as Warner Bros. Discovery, Malone even agreed to part with a special class of stock through which he holds a 26.5 percent voting interest in Discovery. He said he was “delighted to fully support this transaction, without … receiving a premium for my high-vote shares.”

AT&T stockholders will receive shares representing 71 percent of the new company, with Discovery shareholders owning the other 29 percent, even though Discovery CEO David Zaslav and CFO Gunnar Wiedenfels will run the merged entity. In a further signal that AT&T shareholders will hold a majority of the merged firm, the telecom giant will name seven members of its board to Discovery’s six.

These intricacies led to some initial confusion upon the deal’s unveiling, with some investors wrongly believing AT&T itself, rather than its shareholders, would own a majority of the combined Warner Bros. Discovery when the deal closes, which is expected by mid-2022.

The transaction will help AT&T reduce its debt load thanks to cash it will get in the deal and by shifting some of its debt to the merged company. The telecom giant said it would receive $43 billion in the transaction “in a combination of cash, debt securities and WarnerMedia’s retention of certain debt.”

One element of the Reverse Morris Trust structure raising questions is how AT&T will distribute shares of the WarnerMedia SpinCo to its stockholders. The options are a spinoff, in which AT&T stockholders would receive shares in the new company in addition to their existing AT&T shares; a split-off, which would allow shareholders to choose between stock of AT&T or the SpinCo; or some combination of the two.

“All options are on the table,” AT&T CFO Pascal Desroches said in September, adding that a decision would come closer to the deal close and involve, among other things, considerations about the value and upside of each business. “We feel really good about using all those options to optimize value for shareholders.”

Branding and history buffs wondering where the name of this rare deal structure comes from will find that Morris Trust and Reverse Morris Trust deals go back to a 1966 tax ruling in favor of the Mary Archer W. Morris Trust in a legal case over its stake in a bank that had merged. This set a precedent that companies with the right kind of deal in mind can benefit from a transaction without having to worry about potential tax bills that could run into the billions of dollars. Says Begley, “Taxes destroy value.”

In Other NEWS